Be eligible for a lender Report Financing toward Mind-Working

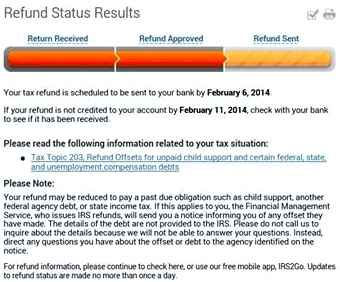

Given that home loan drama of 10 years before possess altered how mortgages are provided, the lending company statement loan program has been offered in best facts. Such non-accredited mortgage loan requires particular documentation for the down payment and earnings, however it shall be an excellent choice low-qm financing selection for thousands of mind-employed people who need to get a mortgage.

How can Bank Declaration Financing Works?

Lender statement fund was in fact referred to as mentioned earnings. When the a borrower got a sufficiently satisfactory credit score, constantly 700 or more, then your mortgage lender would allow brand new debtor to find an excellent financing instead of providing tax statements, bank comments, or other sorts of records.

Whenever you are modern financial declaration financing aren’t so easy, they however render a great financing solution to people who own their people.

Savvy advertisers get top-notch tax accounting firms to assist them take advantage of the tax laws and reduce the team earnings which have courtroom deductions, therefore lowering their taxation liability at the end of the year.

However, the low money reported to the taxation statements suppresses advertisers regarding being qualified towards family of its aspirations. That is where the exact opposite paperwork will come inside helpful and you can lets mortgage individuals to utilize lender statements to show its money differently.

The contrary records use your bank statements away from 12 months or even two years. Financial statements will show deposits into your bank account along side long-term and mean that the organization are generating an income that the customers are using due to their individual have fun with.

Read moreBe eligible for a lender Report Financing toward Mind-Working