FORT WAYNE, Ind. (WPTA) – Numerous in the future-to-be Fort Wayne home owners is losing their houses just after capital are clipped of good You Agency away from Agriculture (USDA) financing system.

By clipped, leaders with Lancia Homes and you can Granite Ridge say specific optimistic household customers does not found what they were assured through the program.

“I have just been dreaming about the way i was going to beautify it,” Gayle Topp said. “I’ve been buying anything. I bought particular lighting and you can fans that have to wade right back.”

Gayle Topp is a partial-resigned senior high school teacher. Just after many years of shopping for a house, Topp claims the guy chose to concert tour a great Lancia Homes model house receive inside the Coves during the Copper Creek from inside the Huntertown. Shortly after speaking-to the new agent, according to him the guy located a house structure he decrease crazy having.

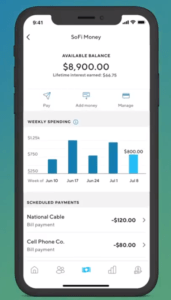

“That is once they explained regarding USDA Head 502 Loan that would benefit me,” Topp said. “It actually was the only www.paydayloancolorado.net/crestone/ way I am able to afford which $300,000 family.”

Topp states he experienced the method for preapproval, was approved, and you will was informed he was the perfect applicant. With the acceptance, Lancia Land been working with Topp to design their dream domestic. Structure started on March 1 of this year.

“It has for ages been my dream house,” Topp said. “I have constantly liked the fresh craftsman tissues and this family are type away from an ode on craftsman model.”

One or two home down are Topp’s closest friend given that middle school, Draw Jones, who’s also strengthening a property having Lancia using the same USDA mortgage.

Read more‘They took our fantasy’ | USDA funding cut will leave Fort Wayne residents without homes