Danielle Keech

It’s really no magic which our into the-the-wade army life offers us reasonable possible opportunity to buy genuine house. I move all long time, each moving requires the answer to issue, do i need to buy otherwise rent a house?

If the to get is the respond to, the method you will feel a tiny overwhelming. The individuals smaller always the procedure get with ease get lost in the true property slang given that, from the outside, all of it seems an equivalent. Capture financial pre-qualification and you can mortgage pre-acceptance, such as for instance payday loans online Hartselle AL. For every single describes a home loan, the words even look the same, but even with their popular key, he is really a few separate anything.

First step: Company

Ahead of we get towards this type of topics, let’s mention financial providers. To have often pre-certification and you can pre-acceptance getting people relevance, your financial papers has to be in order. You will have to show done factual statements about the debt, possessions, money, and current position of the borrowing from the bank.

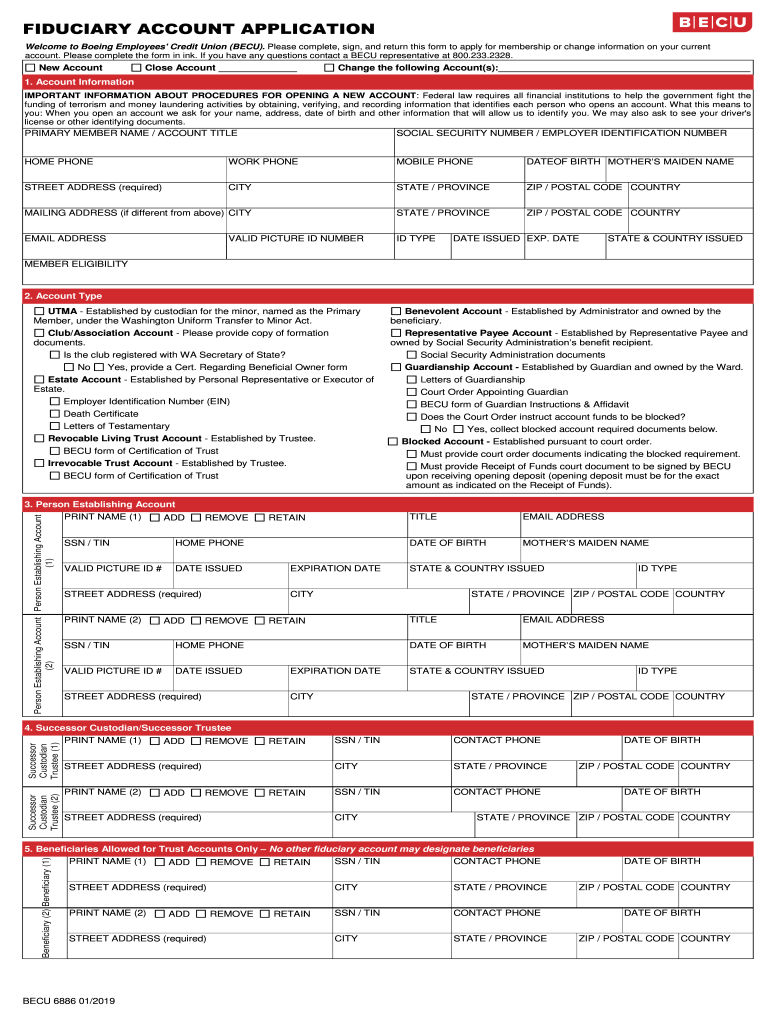

Some tips about what you will need:

![]()

- A listing of your financial obligation, particularly mastercard stability.

- A summary of the property, just like your Honda otherwise Harley.

- Proof your revenue, like your Log off and Earning Report (LES) out of your armed forces MyPay membership.

What exactly is a home loan pre-qualification?

Financial pre-certification is the 1st step of processes, and this will make you a concept of the amount of money you could qualify for on the financial.

Read moreFinancial Pre-Degree vs. Pre-Approval: What it Setting and exactly why They Issues