Save more by mixing and matching the bookkeeping, tax, and consultation services you need.

Purpose of Finding Net Credit Sales on the Balance Sheet

It is typically listed as a separate line item under the revenue section of the income statement. The average collection period measures the time necessary for a company to obtain cash payments from customers. Let’s proceed to the next step, where we will identify the total sales returns and allowances. When looking at gross credit sales, it refers to the total amount of credit sales made by a company before accounting for any discounts or returns. A company’s financial statements contain a great deal of information, and you may not need all of that information at a given time. You can quickly pick out a specific section of that data, such as annual credit sales, if you know where to find it within the statements.

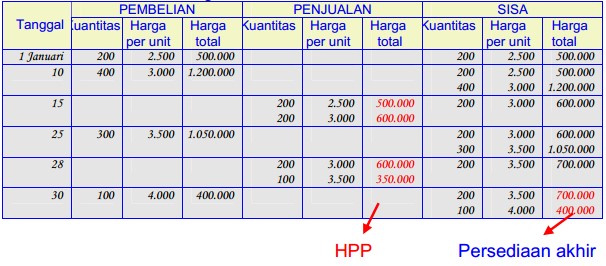

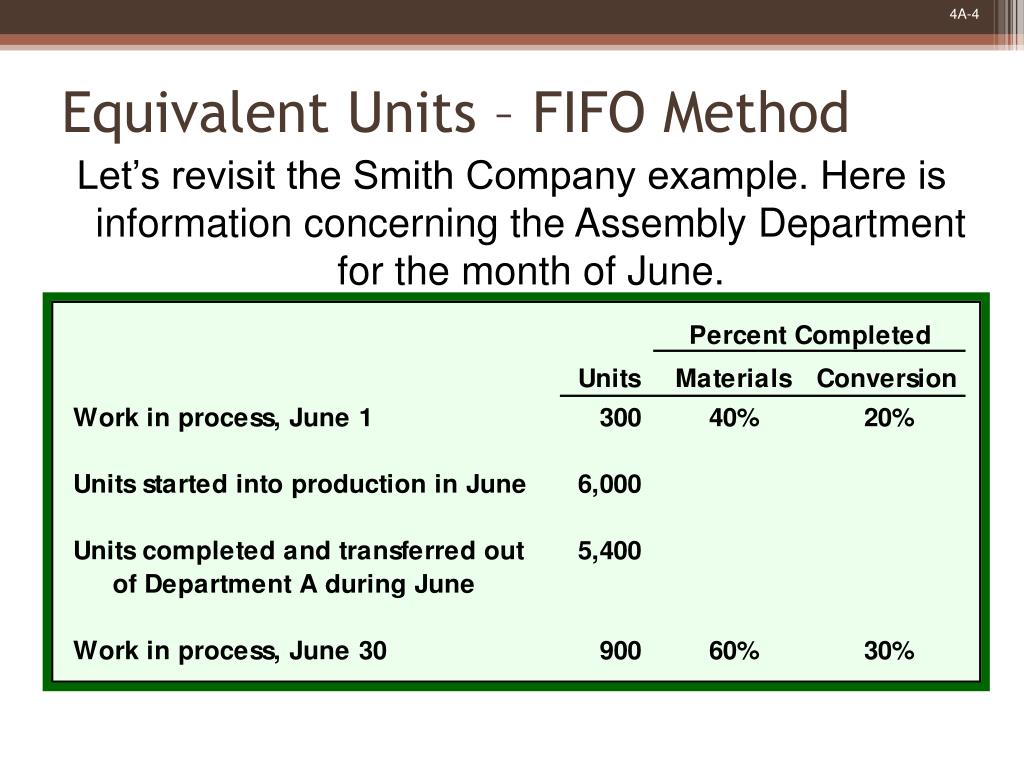

The first step in calculating net credit sales is to determine the total credit sales for the period you are analyzing. Credit sales refer to transactions where customers purchase goods or services on credit, meaning they do not make an immediate payment but agree to pay at a later date based on agreed-upon terms. It’s important to note that the net credit sales calculation focuses specifically on credit transactions and does not include cash sales. Cash sales are payments made by customers at the time of the purchase and are not considered part of net credit sales.

Look for line items specifically labeled as “Sales Returns” or “Allowances.” These figures represent the total monetary value or percentage of sales that have been returned or granted as allowances. Understanding the net credit sales formula is similar to deciphering the heartbeat of a business. Just as a doctor monitors a patient’s heartbeat to gauge their health, a business must track its net credit sales to assess its financial well-being.

Utilizing Accounts Receivable Turnover Ratio for Analysis

Analyzing net credit sales over time and comparing them to industry peers can help identify trends, market competitiveness, and potential areas for where to find net credit sales on financial statements improvement. By segmenting customers, assessing credit policies, and analyzing accounts receivable turnover, businesses can optimize their credit management processes and enhance cash flow efficiency. Understanding net credit sales is important for businesses to evaluate their sales performance and assess the effectiveness of their credit policies. By monitoring changes in net credit sales over time, companies can identify trends and patterns that can help them optimize their credit and sales strategies. Additionally, it provides valuable insights into the company’s ability to collect receivables and manage its cash flow efficiently. Net credit sales are an indicator of a company’s ability to generate revenue from credit sales transactions.

Where to find net credit sales on financial statements?

The information provided on this website does not, and is not intended to, constitute legal, tax or accounting advice or recommendations. All information prepared on this site is for informational purposes only, and should not be relied on for legal, tax or accounting advice. You should consult your own legal, tax or accounting advisors before engaging in any transaction.

The company’s sales include the credit sales amount, and to calculate credit sales from total, we deduct the sales returns and sales allowances. It provides a snapshot of the company’s financial performance and helps stakeholders assess its profitability. Understanding the net credit sales figure and its implications helps businesses make informed decisions regarding credit management, sales strategies, and overall profitability. Calculating the net credit sales helps the company understand its sales performance, evaluate the effectiveness of its credit policies, and manage credit risks. It provides valuable insights into the financial performance of the business, allowing for better decision-making and strategic planning. In the process of calculating net credit sales, the next step is to identify the total sales returns and allowances.

- Net credit sales is a crucial component of the income statement, as it represents the revenue generated from credit sales transactions.

- Regularly reviewing the net sales formula helps companies catch any issues with their accounts receivable turnover ratio early, allowing them to fix problems before they escalate.

- For example, if a company sells $100,000 worth of goods on credit and subsequently receives $20,000 in returns and allowances, the net credit sales would be $80,000.

- To calculate net credit sales, subtract any returns, allowances, or discounts from the total sales figure.

While net credit sales is not directly reported on the statement of cash flows, it does have an impact on the cash flow from operations section, which is a significant component of this statement. Next, we will explore how net credit sales impact the statement of cash flows, providing information about the company’s cash inflows and outflows. Next, we will explore where net credit sales can be found on financial statements and how it influences other aspects of a company’s financial reporting. The gross credit sales metric neglects any reductions from customer returns, discounts, and allowances, whereas net credit sales adjust for all of those factors. This means that the retail company generated $470,000 in revenue from credit sales after accounting for $20,000 worth of returns and $10,000 in allowances. Once you have located the total credit sales figure, make note of it as it will be used in the subsequent steps to calculate the net credit sales.