Now, let’s assume that after the date of the balance sheet, the market price of the shares has risen from $14 per share to $17 per share. In reality, a gain of $3 per share has been made, but it is unrealized because the shares have not been sold by the date of the balance sheet. If we buy shares at $14 per share, a record should be added to the balance sheet at cost. Let’s assume that the shares were purchased purely for speculation purposes (i.e., in the hope that their price will rise and we will be able to sell them at a profit). The prudence principle of accounting is essentially the policy of «playing it safe.»

Fundamental Analysis: Principles, Types, and How to Use It

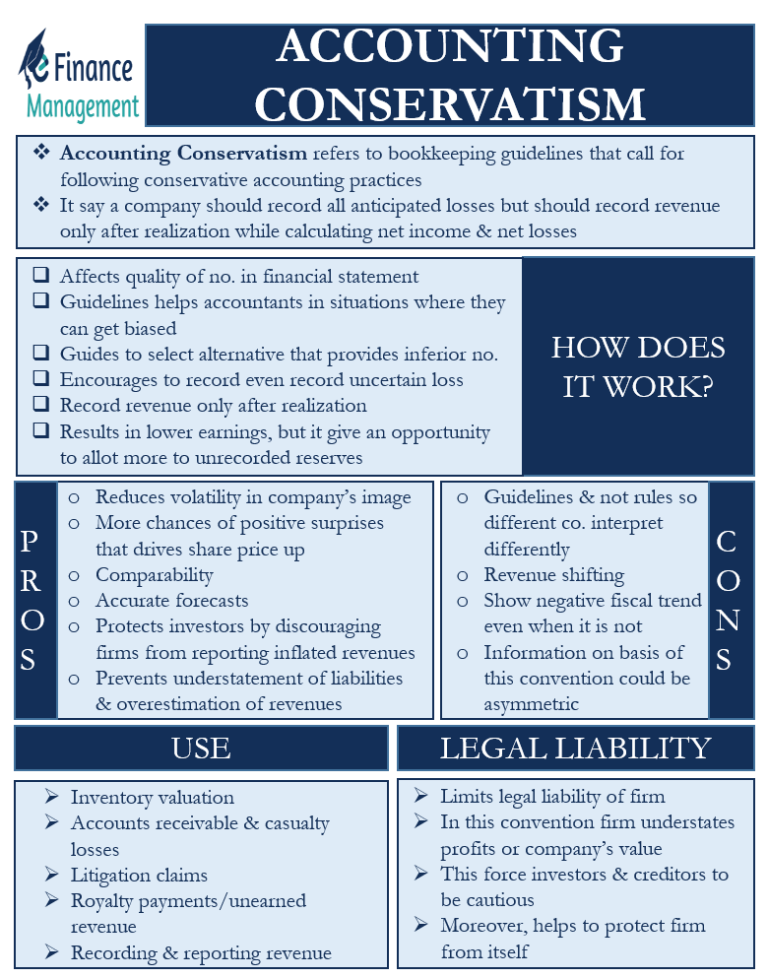

This leads to an imbalance, with the current period understated and the future period overstated. You have already included the worst possible outcomes and lower estimates. It’s all going to depend, as with any GAAP there can be both benefits and disadvantages. And with conservatism accounting, it might seem as though there’s not going to be many benefits.

How confident are you in your long term financial plan?

In simple terms, the entity must not overvalue its profits and assets until irrefutable evidence is obtained. At the same time, it must not undervalue its losses and expenses and must record provisions even if the possibility of their occurrence exists. The conservatism principle is one of the Generally Accepted Accounting Principles (GAAP). They were put into place to help make financial reporting more clear and accurate. With the conservatism approach, you claim profit once it has become verified and realized. This approach makes it easier for them to understand and compare financial statements.

Ask a Financial Professional Any Question

Here we discuss the conservatism principle in detail, practical examples, and its impact on the financial statements. The two main aspects of the conservatism principle of accounting are – recognizing revenue only if they are confident and recognizing expenses as soon as possible. Remember, the conservatism principle doesn’t say that we always have to estimate outcomes unfavorably.

Recording of liabilities and expenses

It can throw off all your calculations and cause a headache you would surely like to avoid. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Ask a question about your financial situation providing as much detail as possible.

- For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

- Conversely, if there is uncertainty about recording a gain, you should not record the gain.

- Understating gains and overstating losses means that accounting conservatism will always report lower net income and lower financial future benefits.

- The conservatism principle is one of the Generally Accepted Accounting Principles (GAAP).

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. For the loss case, let’s assume that on the date of the balance sheet, the shares are being sold at the stock exchange at $12 per share. However, should the value of these shares go below $14 per share on the date of the balance sheet, it would be prudent to book the loss. In IAS2 cloud computing (International Accounting Standard for Inventory), the inventory is always valued at the lower of the original cost or net realizable value (i.e., selling price less cost to sell), so that inventory may not be overvalued. The valuation of inventory directly impacts the cost of sales because the cost of sales is equal to opening stock plus purchases minus closing stock. There’s nothing worse than spending the time to do your bookkeeping only to have a small mistake.

The principle of conservatism gives guidance on how to record uncertain events and estimates. The principle of conservatism states that you should always error on the most conservative side of any transaction. Most of the time this means minimizing profits by recording uncertain losses or expenses and not recording uncertain or estimated gains. The purpose and objective of the conservatism principle is to ensure that financial statements provide a fair and conservative presentation of an entity’s financial position and performance, even in the face of uncertainty. Under the conservatism principle, assets and revenue could be recorded or recognized unless it is clear that the entity could measure those transactions reliably. In addition, the expenses and liabilities are records at the highest value where assets and revenues are recorded at the lowest value.

The amount of the inventory write-down is reported on the current income statement. While the conservatism principle is an important accounting principle that promotes a fair and conservative presentation of an entity’s financial position and performance, it also has several limitations that should be considered. At first glance, it might seem like there are few advantages of conservatism in accounting. After all, you’re overstating losses and understating profits, which can lead to your business’s finances looking worse on paper. By applying the Conservatism Principle, the company is taking a more cautious approach, recognizing a potential loss in anticipation of uncertainties. This results in a more conservative representation of the company’s financial position on the balance sheet.

For example, the entity should recognize the liabilities that claim to the employee for the legal case even the entity not sure if they are failing. Imagine Company A has some accounts receivable (money owed by customers) that total $10,000. However, there is uncertainty about whether all customers will be able to pay their debts due to economic challenges in the industry. This can get done any time that you expect to have gains but you’re not entirely sure what the specific amount will be. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

These doubtful debtors are included in the provision under the prudence concept of accounting. Following this approach, you can only claim profits once they have been realized and verified. Basically, uncertain liabilities are going to get recorded once they’re discovered. It requires company accounts to be prepared with caution and high degrees of verification. The point is to factor in the worst-case scenario for a company’s financial future.