Whoever was an NRI and traditions overseas that have latest updates (arriving income) can use for a mortgage inside the Asia.

Documents called for is actually Passport, Charge status, Income comments, Family savings statements, regional target evidence, cheque guides, Label facts an such like. This may start from lender so you’re able to lender.

The other important factor to understand when making an application for an enthusiastic NRI home loan is you should have an NRE otherwise NRO membership where funds would be directed facing fees off financing. No other membership can be utilized (checking/coupons etc).

State Lender regarding India (SBI) NRI Mortgage brokers

Mortgage Sorts of Floating Rate of interest 9 11% Operating Charge .13% up to Rs. ten,100 (75 Lakhs and you may over) Tenure away from financing Doing twenty five years Restriction Maximum amount borrowed Up to 85% out of property value

Existing NRE/NRO customers. NRIs who’ve worked for minimal 2 yrs overseas. Lowest 18 yrs old which have typical source of income.

a) SBI NRI Mortgage (Regular) This type of mortgage enforce when you yourself have finalized the property (flat, already centered domestic, private villas etcetera). You need to get a regard estimate throughout the creator and you will introduce they towards the bank. According to research by the speed imagine, remaining portion of the info will be felt like. This will be advisable that you have the best rate of interest. (Cost as previously mentioned over)

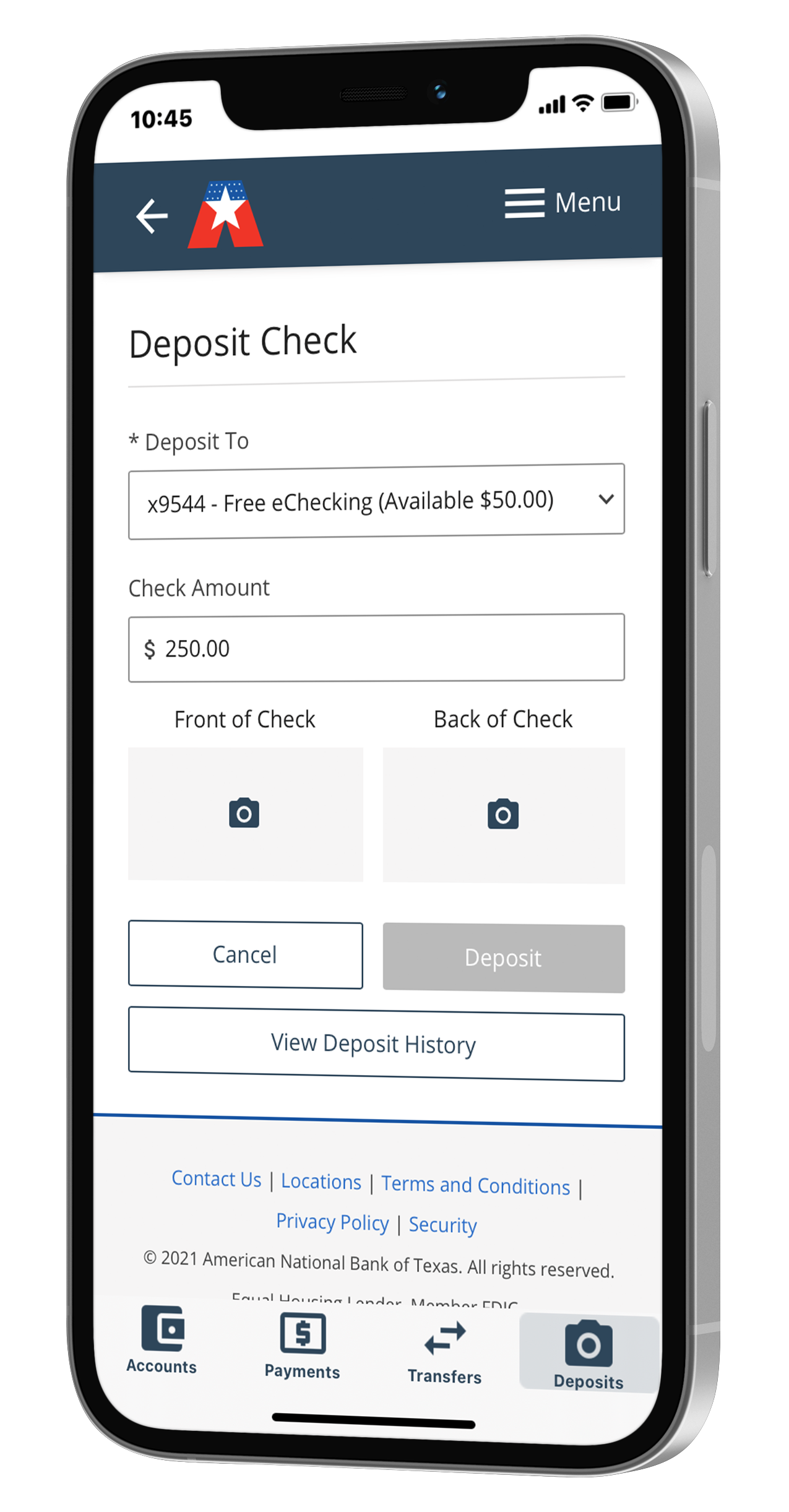

b) SBI Maxgain (Mortgage once the an overdraft) We so it system, financial try sanctioned due to the fact a keen overdraft to the additional independence to perform the house financing account including savings or most recent membership. Cheque publication and you will Websites financial business is even considering in addition to so it and you will park your own excess financing / discounts when you look at the Maxgain account, with a choice to withdraw funds just in case expected. This is exactly good for NRIs who’ve excess money to utilize facing a mortgage.

c) SBI Realty NRI Mortgage brokers for buying land/domestic framework It mortgage system can be found to possess NRIs whom wants to get an article of house otherwise create a property. Midway loan places You should buy to 85% useful of your property otherwise domestic but the design possess to begin with within couple of years out of loan sanctioning.

d) SBI Pre Recognized Financing In this mortgage strategy, you can get a beneficial pre-approved amount of loan predicated on your earnings not on this new possessions. You will have to do the pre-recognized financing statement in order to designers/homeowners and find the proper possessions. Pre-recognized funds are good only for four weeks by the way.

ICICI Bank NRI Home loans

Mortgage Method of Fixed otherwise Drifting Interest nine 13% Operating Fees .50% Tenure regarding mortgage To 15 years Maximum Limit amount borrowed Doing 80% from value of ( otherwise 5 Crores)

Existing NRE/NRO customers. NRIs with struggled to obtain minimum two years abroad. Minimal 18 years old which have typical income source.

ICICI Bank’s NRI mortgage brokers are more easier to score. Minimal importance of NRI’s are 12 months performs history, 25 years of age and valid documents. They create loan for lots more count (if the eligible, even-up to 5 crores INR) but rates of interest should be slightly greater than SBI (often to thirteen%). ICICI provides money so you’re able to self employed somebody also, but you have to be doing work abroad to possess at least three years. To own bachelor education people, the maximum financing tenure date welcome is actually ten years while you are for article graduates loan period might be even fifteen years, in the event the eligible. As opposed to SBI, ICICI Bank doesn’t have one home loan alternative for the pre-recognized home loans. You will need to have picked out your home first and you will repaid your the main money having lender in order to disperse the remaining add up to the creator.