Your earnings can not be over 115% of typical money in your community where you want to choose the property.

At exactly the same time, you should demonstrated what you can do to repay the mortgage on lender, which means that having a steady income source and a good DTI out of 43% otherwise straight down. Direct certificates differ from the lender.

Credit score

The newest USDA does not set credit rating requirements, so it is around the lender. Very lenders like to see a score with a minimum of 640, however might still be eligible for a beneficial USDA mortgage having bad borrowing from the bank, according to the bank or other situations.

Debt-to-income (DTI) proportion

Their DTI measures the amount of your revenues you to definitely happens with the paying the money you owe per month. Really loan providers want to see a beneficial DTI out-of no more than 41%, simple with a lot of style of financing. What this means is you to definitely just about 41% of one’s money goes toward bills instance existing mortgage loans, vehicles and personal finance, handmade cards, and so on.

Area

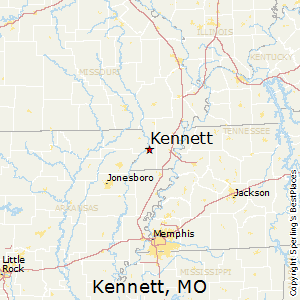

The property must be situated in an eligible outlying town to help you be eligible for a good USDA loan. The new USDA provides an entertaining chart which can help you research having components or particular attributes to choose its qualification.

Property proportions

How big our home can’t surpass 2,000 sqft in order to qualify for a USDA loan. But not, there’s no property dimensions, so your household will likely be found on people amount of residential property.

Safeguards standards

The property need to be structurally sound, secure, and you will functional to qualify for an excellent USDA mortgage. Lenders are required to hire an enthusiastic appraiser having USDA financing features to assess the home to decide the market price and ensure it abides by USDA possessions condition recommendations.

In most cases, appraisers could well be seeking www.cashadvanceamerica.net/loans/guaranteed-approval-10000-loans/ a good structurally sound home with a good foundation and you can roof inside the good shape, enabling children to go when you look at the as soon as possible. Indeed there should also be entry to the home and you may Hvac expertise in operating order.

They are going to and additionally ensure the electronic method is secure no launched wires hence brand new plumbing system is actually useful. On the other hand, your house are unable to has actually proof damage from insects and must follow to help you local and you may county strengthening codes.

FHA against. USDA Finance

USDA and you may FHA financing are two of the very most preferred government-recognized loans while they reduce the costs of purchasing property. But not, they’ve been aimed toward different kinds of individuals. As an instance, USDA finance is getting individuals looking to purchase possessions on the rural house and therefore are limited to own lower- to help you center-income families.

Concurrently, FHA loans, supported by the newest Government Casing Administration, become more accessible having borrowers and you will characteristics of all types. There are not any income limitations having so much more credit score criteria self-reliance – score as little as 550 was recognized. Additionally, USDA finance include a no downpayment alternative, if you find yourself FHA funds nonetheless need a down payment, despite the fact that is as lower given that step three.5%.

Borrowers who don’t qualify for USDA finance might still qualify for FHA finance. In addition, this type of money are more desirable if you don’t must become restricted to a particular area.

Each other software are around for no. 1 residences only, however with FHA funds, you can buy multi-family relations residential property with several equipment. At the same time, each other accommodate first-go out domestic client has to further reduce your costs of buying a property.

Positives and negatives regarding USDA Loans

No downpayment needs and much more flexible credit conditions, USDA financing is actually attractive to of several borrowers. Although not, they aren’t suitable selection for most of the household consumer. Reading the huge benefits and you will cons of USDA financing makes it possible to improve most useful decision predicated on your debts and you will a lot of time-name specifications.