By providing the desired records and you will in the process of the fresh check processes, borrowers normally demonstrate their readiness so you’re able to carry on a property venture and their dedication to meeting the requirements of this new FHA build mortgage.

Being qualified for an FHA framework mortgage is an important part of being able to access the credit wanted to make otherwise redesign a house. Of the conference the financing get and you may deposit criteria, including providing the expected papers and you can in the process of examination, individuals can also be condition themselves for achievement when you look at the obtaining an FHA framework loan.

Getting an FHA Design Loan

Among the secret issues was coping with an FHA-recognized lender, because not totally all FHA lenders provide these financial support. In addition, making certain new company and creator fulfill certain certificates is essential.

Coping with an enthusiastic FHA-Approved Financial

To acquire an enthusiastic FHA build mortgage, consumers have to affect a keen FHA-acknowledged bank and now have preapproved to possess funding . It is very important note that not totally all FHA lenders render framework funds, therefore it is wanted to pick a loan provider you to focuses primarily on so it style of capital. The brand new You.S. Service away from Homes and you may Urban Creativity brings a list of lenders categorized because of the condition otherwise state, and is a helpful funding finding a keen FHA-accepted lender which provides build money.

Working with an FHA-recognized lender brings several advantages. These lenders enjoys knowledge of handling the unique criteria and operations on the FHA structure loans. They are aware the particular paperwork and you can certification requisite, putting some loan application and you may acceptance procedure much easier.

Company and Builder Qualifications

When obtaining a keen FHA structure mortgage, it’s essential to work with an experienced specialist and you may creator. The fresh FHA features certain criteria and you may criteria one to contractors need fulfill become entitled to the loan. The financial institution tend to usually comment the new contractor’s certificates to be certain they feel the called for sense and you may assistance to accomplish the building otherwise renovation investment.

The fresh builder have to have a legitimate contractor’s license and you will a great track record of finishing similar plans effortlessly. It’s important to choose a contractor just who understands the brand new FHA framework financing processes and that’s willing to really works within its guidance.

Along with the contractor’s certificates, this new creator as well as their cluster need a thorough understanding of brand new FHA structure financing criteria. This can include adhering to the guidelines and you will regulations established of the this new FHA to make sure a successful financing process.

From the dealing with an enthusiastic FHA-recognized financial and certified company, borrowers can be navigate the procedure of obtaining an enthusiastic FHA build mortgage more effectively. These professionals usually guide borrowers from necessary strategies and ensure that most criteria are fulfilled, enhancing the likelihood of a silky and you will successful financing sense.

FHA Design Mortgage Processes

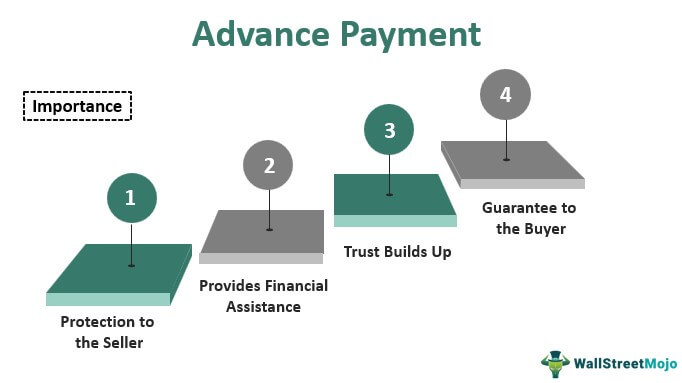

Protecting financing having a property opportunity because of an enthusiastic FHA structure financing concerns a step-by-action procedure. It section usually explanation an important methods to safe resource and the procedure of converting the loan so you can a long-term mortgage.

Steps to help you Secure Resource

- Qualify which have an enthusiastic FHA-Recognized Lender: Locate an enthusiastic installment loans no credit check Columbus FHA build mortgage, consumers have to manage an FHA-approved lender. Only a few FHA loan providers provide this type of financial support, so it is crucial that you ensure the selected financial was licensed. The brand new You.S. Agencies regarding Construction and Metropolitan Innovation provides a summary of accepted loan providers by the condition or condition.

- Builder and you may Contractor Qualifications: The fresh creator and you will general builder mixed up in framework opportunity must be entitled to the fresh new FHA framework loan. Lenders generally wanted more information about the builder’s sense, official certification, and you may economic stability. It is vital to work with experts who meet with the lender’s criteria and have a proven reputation effective construction ideas .