Strengthening collateral of your house is an exciting section of homeownership. Building guarantee setting raising the portion of an asset you own – in such a case, the new part of your residence compared to the simply how much you still owe on the financial. Paying their financial is actually an organic technique for building security, however you may be thinking in the event that there are ways to expedite this action. Let’s see.

What is family security?

Household guarantee is the level of home you possess than the exactly how much you borrowed. Their downpayment is the basic big sum you make towards your property collateral. The larger the brand new advance payment you will be making, the greater number of household equity you start out-of having. As you repay their mortgage, you begin in order to progressively owe less overall and individual so much more house guarantee.

How do i discover my personal domestic equity?

It’s also possible to assess home collateral because of the subtracting the newest a good balance regarding your own home loan regarding the appraised value of your residence. Particularly, if your residence’s appraised really worth try $eight hundred,000 and your a great financial balance is $100,000, your home collateral will be $three hundred,000.

What makes strengthening domestic equity very important?

Strengthening house guarantee is known as important for several grounds. The fresh overarching theme is the fact a great deal more guarantee offers more control more than the asset. Typically, when you pick property, the target is to own the newest resource and let it take pleasure in over time prior to sooner offering it getting finances.

- Family security fund enables you to borrow on your own guarantee: Borrowing from the bank facing the guarantee form you could profit from the household security if you take away a loan up against it. You may use that it loan to fund most other costs, create home improvements, put money into a different sort of domestic or use it in case there is a crisis. If you’re able to borrow on your own collateral, having this control could possibly get prove beneficial as time goes by.

- The more collateral you’ve got, the more you may also make the most of promoting your home: If you have paid off all your home loan before you can offer the household, you get to store all-potential earnings regarding the sale. In some cases, although not, suppliers might not have paid off their whole financial and are generally required to get it done abreast of new sales of its domestic. For individuals who still are obligated to pay cash on your own financial, this will connect with just how much you cash in on new purchases. Usually, the greater house security you really have, the greater number of currency might enter loans Glendale one sales.

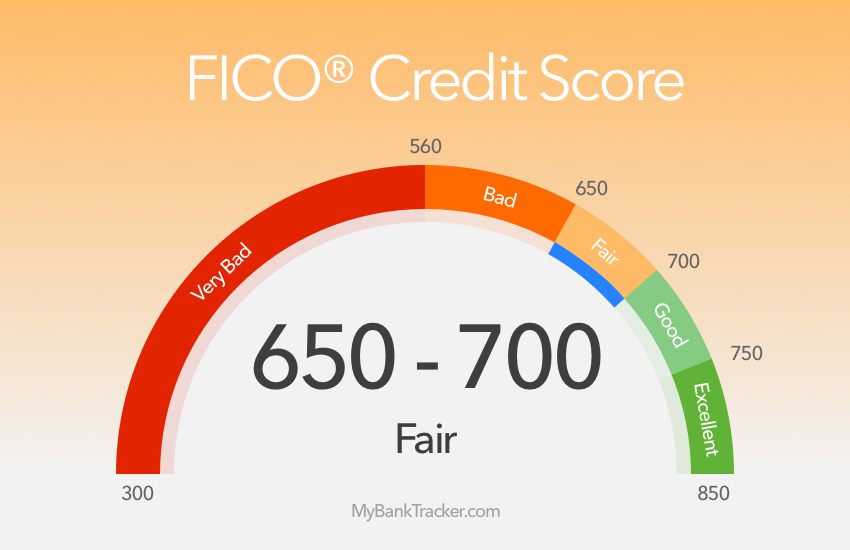

- The ability to use your house equity to lessen your financial situation and you can alter your creditworthiness: Cashing when you look at the on the domestic equity can help spend off most other bills. If you are paying away from almost every other expenses, you will be decreasing the debt-to-income ratio and ultimately, boosting your financial health and creditworthiness.

How to build equity during the property

There are a few ways to create security inside a house, and several help you facilitate how much cash guarantee you build in the a shorter time:

- Create regular mortgage payments: Whenever you are taking out fully a mortgage, it’s best routine and come up with typical, timely mortgage payments. When you build costs timely, you stop late costs and you can compounding appeal. With each payment one to visits their principal, you happen to be providing generate domestic guarantee.

- Make very early otherwise most mortgage repayments: If you’re to make early or extra mortgage repayments towards your dominant, you may be potentially strengthening household equity faster by ortization schedule.

- Perspiration collateral:Sweat security is hard works that create worth. For example, instead of paying for a builder and make property improvement, you might decide to conserve that cash and then try to need for the enterprise yourself. The money stored and you can prospective value-added to your house get improve domestic equity.

- Renovations: Through renovations you to definitely improve value of your property, you might be along with boosting your family guarantee. Such as, completing the basements and you may incorporating a bathroom boosts the practical rectangular video footage of your property and in the end how much cash someone you will pay for your house, which assists create your household security.

In a nutshell

Building family security is the thought of paying down their home loan and you can slowly possessing more about of your house. Building domestic collateral are fashionable while the you might be increasing your control and you may control over your own resource, that provides your that have opportunities getting monetary self-reliance instance making use of your household security to evolve your house, defense bills or make money when you offer your home. Thought talking to a property financing coach to choose just what professionals you can aquire off making use of your property security.