Number 1 Quarters Mortgage Rules

All the financial application you over calls for you reacting issue regarding how assets you wish to purchase could well be utilized. The options were top quarters, next household, and investment property. The possibility you select will play a part in the determining the mortgage pricing you can aquire. They also have some other requirements that need to be came across prior to the mortgage is going to be recognized.

No. 1 houses normally get the reduced interest levels among around three options. This is because lenders essentially accept that a purchaser could be more inclined to repay a home loan towards home which they live-in. The reality that it’s the rooftop over your face was additional determination to keep up with payments. It is also thanks to this reason why mortgage loans to have primary residences include a low worth having down repayments and generally are the simplest discover.

- You must reside in the home for the majority of of your season.

- The house need to be within this practical distance to the office.

- You have got to begin residing in our home inside a beneficial sixty-day months shortly after closing the mortgage.

To invest in Another Family Which can be Most of your Household

One very important matter to see is the fact property usually do not feel listed since your prie time. Brand new standards differ per class. Another home is normally identified as a house you might live in for almost all the main year. In the place of an initial quarters, you do not have to reside truth be told there for the majority of the season, therefore need not be alongside of working. Vacation belongings are fantastic samples of next homes. They fit the course to be a place you merely real time in for specific a portion of the 12 months, and in addition they dont count due to the fact financial support properties.

You will find some type of loans that can’t be used to purchase an additional household. Instance, you simply cannot use a keen FHA loan or good Va loan so you can buy another household. There are even particular financial considerations that come to the play whenever you are becoming evaluated to have the second real estate loan. A significant exemplory instance of this really is that every lenders are more strict toward loans-to-income proportion of one’s buyer as well as their credit history. Value, location, and you will restoration was three important facts to consider while you are lookin buying another family.

To invest in The second The place to find Rent

To invest in a moment household which will be put since the a rental property boasts loads of positives, most notable where are definitely the taxation deductions. But on the bright side, in addition, it ensures that a purchaser can be a property manager and has certain duties that requires perseverance. It is something that have a moment home you only check out to possess annual getaways, and is a totally various other issue to have a moment domestic that will be leased aside.

In terms of income tax deductions are involved, there’s two criteria less than and that property might be sensed a second domestic. He or she is:

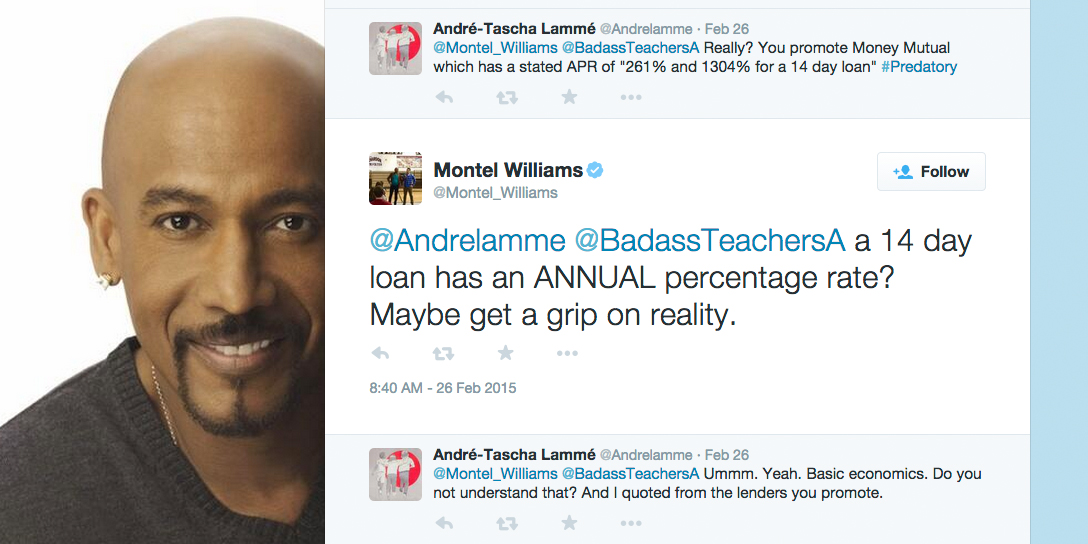

payday loans Winfield no bank account

- You should alive inside possessions for at least 14 days per year.

- You ought to live-in our home for at least 10 percent of your weeks it is rented away.

An example of these standards are fulfilled are a moment home you rent to possess 200 weeks inside a year and you will live in for at least 20 days around. Fulfilling these types of criteria ensures that our home qualifies having one minute home loan.

Considering that second home mortgages are often simpler to be eligible for than just investment property mortgages and you may incorporate straight down focus, what is important on how best to cautiously consider all standards working in meeting them.