Some well-known home loan pricing ticked up-over the final week. While you are looking for a mortgage, see how your repayments would be impacted by rate of interest hikes.

Some tall mortgage cost inched up-over the past few days. The typical rates of interest for both fifteen-season repaired and you will 31-year repaired mortgages each other crept highest. We as well as noticed an increase in the typical price of five/step 1 variable-rates mortgage loans.

Home loan pricing have been increasing consistently as the start of the 2022, following the on the aftermath from some interest hikes by Federal Set aside . Rates of interest was vibrant and unstable — at the least towards an everyday or a week base — in addition they answer numerous financial circumstances. However the Fed’s steps, built to decrease the new higher level from rising prices , are having an unmistakable affect home loan cost.

If you’re looking buying property, seeking to big date the market industry may not enjoy to the like. When the inflation will continue to improve and cost continue to ascend, it can most likely convert to higher interest rates — and steeper month-to-month mortgage payments. As a result, you have got best fortune locking during the a lowered mortgage desire rates sooner rather than later. It does not matter when you decide to order a property, it’s always smart to choose multiple lenders to help you compare costs and you can fees for the best mortgage for the certain state.

How-to search for an educated financial rate

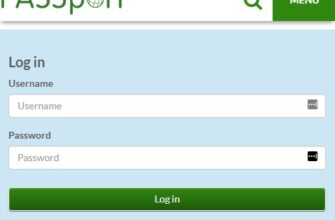

To obtain a customized home loan rates, consult your regional mortgage broker or explore an internet home loan provider. When looking into the mortgage prices, consider your specifications and you will newest money.

A variety of issues — as well as your downpayment, credit history, loan-to-value ratio and personal debt-to-income proportion — usually all apply to your own financial price. Basically, you want good credit, increased downpayment, a reduced DTI and you will a lowered LTV to get a lower interest rate.

The speed isn’t the just factor that impacts the purchase price of your home. Make sure you contemplate additional factors such as for example charge, settlement costs, fees and you can disregard situations. Be sure to talk to multiple lenders — such as, local and you may federal banks, credit unions an internet-based loan providers — and you can comparison-store to find the best mortgage to you personally.

What’s the best financing title?

One bottom line you must know when selecting home financing is the loan identity, or fee agenda. The mortgage terminology mostly considering is actually 15 years and 29 age, as you may also see 10-, 20- and you may forty-seasons mortgage loans. Another essential huge difference try anywhere between fixed-rate and variable-rate mortgage loans. Having fixed-rate mortgages, interest rates are the payday loans Taylor same towards lifetime of the loan. Instead of a predetermined-price mortgage, the interest rates having a varying-rates home loan are only secure for a certain amount of go out (always five, seven otherwise a decade). Up coming, the interest rate transform annually based on the industry interest.

Whenever choosing anywhere between a predetermined-rate and you will variable-price home loan, you should look at how much time you intend to help you remain in your home. Fixed-price mortgages could be a much better fit for individuals who package into living in property for a while. When you find yourself varying-price mortgages might offer all the way down interest levels initial, fixed-speed mortgages be secure in the long run. Although not, you can aquire a better handle a changeable-speed home loan while you are simply probably keep the household for a few years. There is absolutely no ideal loan name as a general rule; it all depends on the requires and your current financial climate. Make sure to shop around and you may consider carefully your own priorities when selecting a mortgage.