Since banks deal with various documents that need to be notarized, people frequently wonder if banks provide notary services . If you’d like to find out whether a Wells Fargo notary can notarize your documents, you’re in the right place. DoNotPay will help you create any contract and tell you how to notarize documents in a few clicks.

Can Banks Notarize Documents?

Most banks in America employ notaries public to notarize contracts, which is convenient for their clients. A notary is a government-authorized official whose job is to be an impartial witness to the signing of various legal documents. A notary’s duties include:

- Verifying the identities of the signing parties

- Ensuring that both parties know what they are signing

- Establishing if the parties are signing the documents of their own free will

- Identifying a fraud

If the process goes according to the rules, the notary will verify the signatures on the document by https://clickcashadvance.com/loans/installment-loan-direct-lenders p and signing it.

While you’re not legally required to visit a notary for every document, you should consider getting the following document notarized:

Does Wells Fargo Have a Notary?

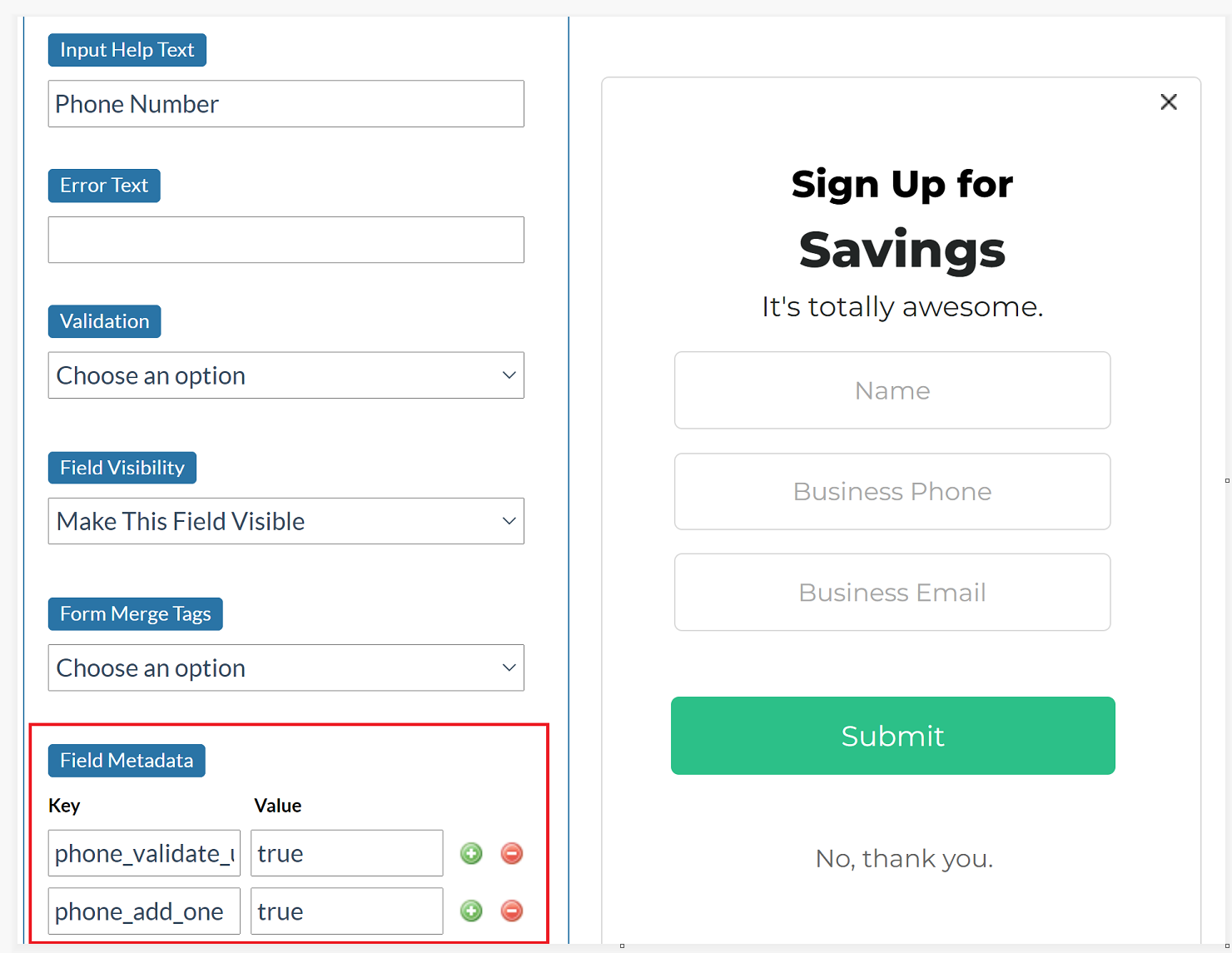

- Visit the Wells Fargo website

- Click on the ATMs/Locations tab

- Enter your address or ZIP code and tick the Notary Service box

- Click on Search

You’ll be presented a list of the closest bank branches that offer notary services. Once you choose your preferred location, you should give them a call to schedule an appointment with a notary public.

Read moreCan You Have Any Contract Notarized by a Wells Fargo Notary Public?