With each sale, the software also updates the COGS account with a debit. The retail sales for this product in this company were $25,000 from Jan. 1, 2019 to Jan. 15, 2019. Based on the examples shown above, Pinky’s Popsicles ending inventory and cost of goods sold is the same – regardless of the method used! Utilizing the FIFO assumption, you can see that if prices are rising, the FIFO method will result in the highest ending inventory compared to other inventory cost flow assumptions. In our Pinky’s Popsicles example, the prices were rising because Batch 1 was purchased for $0.75 per unit, whereas Batch 2 cost $0.90 per unit. Because the prices for goods are increasing, Pinky’s is selling their cheaper inventory items first.

Related AccountingTools Courses

The result should provide an ending inventory estimate and how much to claim as the bottom-line figure for this period. When you sell products in a perpetual inventory system, the expense account increases and grows the costs of sales. Also called the cost of goods sold (COGS), the costs of sales are the direct expenses from the production of goods during a period. These costs include the labor and materials costs but leave off any distribution or sales costs. This system works by the company accountant recording all purchases into a purchase account.

First-in, first-out (FIFO) method in periodic inventory system

- Therefore, the perpetual FIFO cost flows and the periodic FIFO cost flows will result in the same cost of goods sold and the same cost of the ending inventory.

- Under the FIFO method, it’s assumed that the oldest inventory items are sold first.

- On the flip side, if prices fall during the year, FIFO will have the lowest ending inventory and the highest cost of goods sold.

- Regardless of which cost assumption is chosen, recordinginventory sales using the perpetual method involves recording boththe revenue and the cost from the transaction for each individualsale.

- Properly managing inventory can make or break a business, and having insight into your stock through the perpetual inventory method is crucial to success.

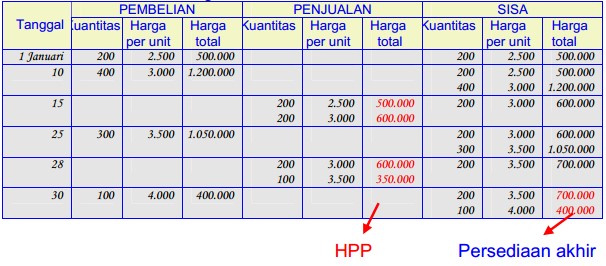

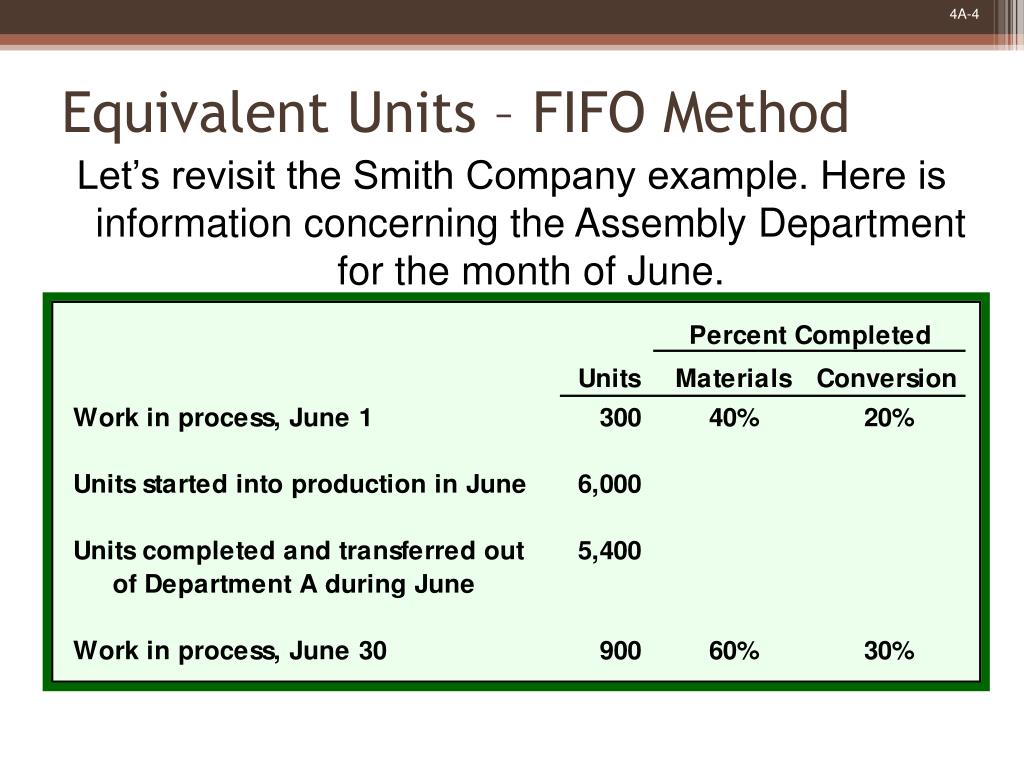

The example given below explains the use of FIFO method in a perpetual inventory system. If you want to understand its use in a periodic inventory system, read “first-in, first-out (FIFO) method in periodic inventory system” article. The company makes a physical count at the end of each accounting period to find the number of units in ending inventory.

Cost Data for Calculations

Perpetual inventory systems are helpful for those who always need to understand margins and profitability. A large business with many products or a company that wants the ability to scale an emerging business over time would use a perpetual inventory system. Even though GAAP standards say that either perpetual or periodic systems are appropriate for any business, each is more suited to different-sized organizations. Overall, perpetual systems are more suited to companies that have high sales volume or multiple retail locations because it is a timelier system. Periodic systems could hinder decision-making for these types of organizations.

Perpetual vs. Periodic Inventory Systems

Periodic systems are more suitable for businesses not affected by slow inventory updates. These include emerging businesses, ones that offer services or companies that have low sales volume and easy-to-track inventory. Companies whose staff struggle with a perpetual system, for instance those with seasonal help, would also benefit from maintaining a periodic system.

Advantages of FIFO Method:

Here’s a summary of the purchases and sales from the first example, which we will use to calculate the ending inventory value using the FIFO periodic system. First, we add the number of inventory units purchased in the left column along with its unit cost. With access to real-time data, salespeople can provide accurate shipping information, manage expectations and provide a better customer experience that directly impacts your reputation. Integrating the inventory software with marketing systems provides that team with a current snapshot of what is selling and what is not.

The real value of perpetual inventory software comes from its ability to integrate with other business systems. For instance, real-time inventory information is vital for the financial and accounting teams. Inventory can make up a large part of your stated assets, so integrating inventory management with financial systems helps ensure accurate tax and regulatory reporting. Perpetual inventory is a continuous accounting practice that records inventory changes in real-time, without the need for physical inventory, so the book inventory accurately shows the real stock. Warehouses register perpetual inventory using input devices such as point of sale (POS) systems and scanners.

First In First Out (FIFO) means the first inventory in will also be the first inventory to be sold. Depending on our Inventory system, we can use either FIFO Periodic or FIFO Perpetual. Note that there are other approaches available, such as Last In First Out (LIFO), but this is not an appropriate costing approach for reporting purposes, so we are not going to review it. Make sure to check out our videos on FIFO inventory calculations video and FIFO inventory journal entries at the end of the post. When I think of FIFO, it reminds me of milk being sold at the grocery store. Inventory is valued at cost unless it is likely to be sold for a lower amount.

Additionally, cloud-based inventory management systems are often real-time, a key element of a perpetual inventory system. It’s also the most accurate method of aligning the expected cost irs issued identification numbers explained flow with the actual flow of goods. It reduces the impact of inflation, assuming that the cost of purchasing newer inventory will be higher than the purchasing cost of older inventory.