A general ledger is an accounting record that compiles every financial transaction of a firm to provide accurate entries for financial statements. The double-entry bookkeeping requires the balance sheet to ensure that the sum of its debit side is equal to the credit side total. A general ledger helps to achieve this goal by compiling journal entries and allowing accounting calculations. A ledger account contains information about a particular account’s opening and closing balances and the periodical debit and credit adjustments based on daily journal entries. A ledger account’s most important information is the periodical (usually annual) closing balances about a specific item or charge. The ledger accounts are essential in the formation of trial balances and the company’s financial statements.

- In the double-entry system, each financial transaction affects at least 2 different ledger accounts.

- The ledger uses the T-account format, where the date, particulars, and amount are recorded for both debits and credits.

- Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

- Preparing a ledger is vital because it serves as a master document for all your financial transactions.

- For instance, cash activity is usually recorded in the cash receipts journal.

Accounting for Ledger Accounts

Individual transactions are identified within the ledger account with a date, transaction number, and description to make it easier for business owners and accountants to research the reason for the transaction. Another important fact to note stems from the fact that total assets are equal to total liabilities and capital at any given time. Any increase in liability is recorded on the credit side of the account, while any delivery equipment in accounting decrease is recorded on the debit side. Any increase in an asset is recorded on the debit side of the relevant account, while any decrease in an asset is recorded on the credit side. The only difference is that the balance is ascertained after each entry and is written in the debit or credit column of the account.

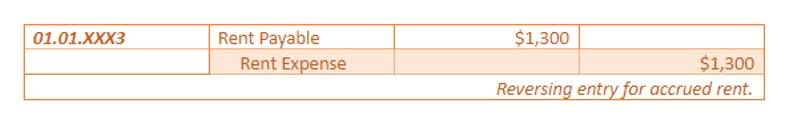

Journal entries are recorded in chronological order, making it easy to identify the transactions for a given business day, week, or another billing period. By contrast, entries in a ledger might group like transactions into specific accounts to assess the data for internal financial and accounting purposes. After recording the opening balances (i.e., the amounts at the beginning of an accounting period) in the ledger account, the next step is to record transactions as they take place. The double-entry accounting method requires every transaction to have at least one debit (incoming money) and one credit (outgoing money) entry, which must always balance out. It is important to note, however, that the number of debit and credit entries does not have to be equal, as long as the trial balance is even.

Have more time to work on what you love when you spend less time on bookkeeping. General ledgers, also referred to as accounting ledgers, are the physical or digital record of a company’s finances. These accounts are balanced at the end of each accounting period, typically at the end of the month, quarter, or year. Balancing a ledger account involves verifying the total debits equal the total credits for the account. Balancing this account is vital average monthly bookkeeping fees because it ensures that it is accurate and complete. If bookkeeping and accounting are done correctly, the sum of the trial balance’s debit side and credit side will match.

Recording Transactions in Ledger Accounts

However, if you want to create your own general ledger, you’ll first need to understand the basics of double-entry bookkeeping. An accounting ledger is used to prepare a number of reports, such as balance sheets and income statements, and they help keep your small business’s finances in order. However, they can provide users with more insight into their financial transactions which may give them the ability to make better decisions as managers or owners of a business.

What are the types of accounting ledgers?

This is why this type of account is also called the periodical balance format of a ledger account. The bank statement style lends itself to modern accounting, but for the time being, double entry will be explained by the older traditional method. The record of trading transactions is kept on the folios or pages of these account books, called ledgers. The ledger folios have special rulings to suit the needs of the business. The ledger is the principal book of accounts in which transactions of a similar nature relating to a particular person or thing are recorded in classified form. A private ledger is where accounts of confidential nature are recorded.

Then, debit and credit values will undergo further calculations to arrive at a final balance of different accounts. It shows all of the activity for accounts receivable for the month of April, including debits and credits to the general ledger account and the net change to the account for the month. Summarize the ending balances from the general ledger and present account level totals to create your trial balance report. The trial balance totals are matched and used to compile financial statements.

Ledger Account Examples

The ledger uses the T-account format, where the date, particulars, and amount are recorded for both debits and credits. In this instance, one asset account (cash) is increased by $200, while another asset account (accounts receivable) is reduced by $200. The net result is that both the increase and the decrease only affect one side of the accounting equation. Any increase in capital is also recorded on the credit side, and any decrease is recorded on the debit side of the respective capital account.